Veja versão em português aqui.

Impact of International Prices on Brazilian Trade Balance.

The value of Brazilian exports have risen significantly in recent years, reaching almost $ 250 billion in 2011 (over 12 months through September 2011), an increase of 87% compared with the same period of 2006 (See the main commodities exported by Brazil in http://migre.me/61v9b). Imports also grew strongly during the same period, with increase of 150%.

This article have a purpouse to present, in the case of exports, that rising prices explains most of the increase in revenue, and in the case of imports, the increase in volume is responsible for its growth. This study is partly based on working paper done by the Central Bank of Brazil, available in http://migre.me/61tXB.

To carry out this study, we used data from the Ministry of Development of Brazil (MD) available at aliceweb2.mdic.gov.br. We used the chapters of the NCM - Mercosul Common Nomenclature, which divides the goods exported and imported in 97 different categories. The MD discloses, for these 97 categories, the value traded in U.S. dollars and volume in kilograms. The average price for each category was calculated simply by the ratio financial value to the volume.

As time basis for this study, we are considering as "year" the accumulated period of 12 months ending in September, as the latest available is September 2011, and this author found it interesting to use the data on an annual basis. So when we speak “2006”, we are referring to the period between October 2005 and September 2006, and so on.

We estimated the impact of international prices of exports in the years 2007 to 2011. For this, we fixed the volume exported in 2006. For example, to know the impact of prices on the exports of 2007, we kept the volume of 2006 with 2007 prices, and so on, until the year 2011, ever with the volume of 2006 fixed. The impact of the rise in volume on exports or imports value was calculated on the difference between the effective value of exports or imports of 2011 and the estimated value with constant volumes. The results are presented in Chart I and in the following comments:

Chart I

|

Source: Ministry of Development of Brazil

Elaboration: the author |

In 2006, the financial value of exports reached USD 132.6 billion. In 2007 and 2008, the increase in international prices was responsible for the increase of 12.9 billion and 38.9 billion in exports, respectively. In 2009, a fall in international prices reduced export revenues in USD 13.8 billion. In 2010 and 2011, with the return of global growth, prices rose again, and the impact on revenue was 17.6 billion and 42.5 billion in these years. The increase in volume represented only USD 16.3 billion in aditional value to exports between 2006 and 2011.

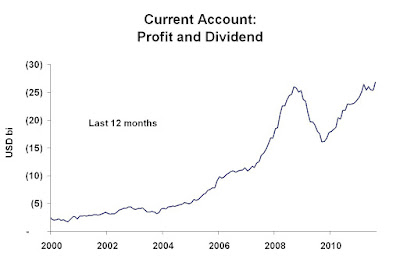

Regarding imports, the effect is the opposite. The volume of imports rose from USD 86.2 billion to 216.5 billion between 2006 and 2011, mainly explained by the increase in volume: USD 95 billion, and to a lesser extent, higher prices: $ 35 billion. Chart II shows the impact of international prices in expenditures on imports between 2006 and 2011.

Chart II

|

Source: Ministry of Development of Brazil

Elaboration: the author |

This result shows some worrying results. Brazil is increasing the physical volume of imports but not exports. The increase in imports have been financed by an increase in prices of exported products, and not by an economic dynamism that could increase competitiveness and increase the volume exported. Thus, the Brazilian trade balance today is very dependent on the dynamics of international prices, which may be a risk to the balance of payments if there is a reversal of this trend in commodity prices.